Mortgage Services

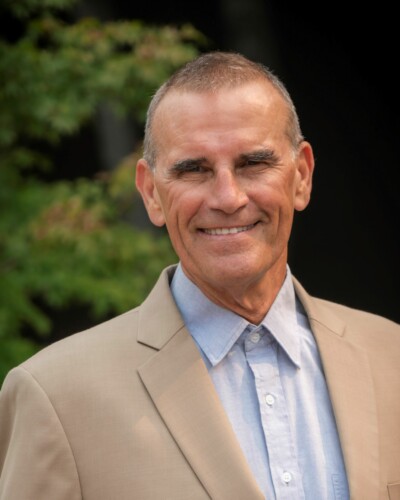

Ryan Nordby

916-600-6480

www.ryannordby.com

Ryan@nordbyteam.com

4011 Woodcreek Oaks Blvd, #110

Roseville, CA 95747

Ryan Nordby believes that a well-informed client is a satisfied client. Using communication as a foundation, he continuously meets his goal to have all parties leave the closing table happy and satisfied with the decision they made. His attention to detail and ability to personalize his service to fit the particular needs and financial vision of his clients sets him apart-he’s not interested in cookie-cutter loans or cutting corners. He wants every client to have a solid understanding of their options, so he focuses on providing clear explanations of all the choices available. Ryan has 11 years of industry experience and specializes in jumbo, FHA and VA loans. Living in Placer County for the past 31 years, he has a unique insight into the Sacramento Valley market and the trends defining the surrounding communities. In his free time, Ryan can be found playing with his three children and enjoying many outdoor activities, especially snow and water skiing. If you’re in the market to refinance or buy a new home and you want to work with a true professional who keeps you informed and involved throughout the process, put the power of Ryan Nordby to work for you today!

Ryan Nordby believes that a well-informed client is a satisfied client. Using communication as a foundation, he continuously meets his goal to have all parties leave the closing table happy and satisfied with the decision they made. His attention to detail and ability to personalize his service to fit the particular needs and financial vision of his clients sets him apart-he’s not interested in cookie-cutter loans or cutting corners. He wants every client to have a solid understanding of their options, so he focuses on providing clear explanations of all the choices available. Ryan has 11 years of industry experience and specializes in jumbo, FHA and VA loans. Living in Placer County for the past 31 years, he has a unique insight into the Sacramento Valley market and the trends defining the surrounding communities. In his free time, Ryan can be found playing with his three children and enjoying many outdoor activities, especially snow and water skiing. If you’re in the market to refinance or buy a new home and you want to work with a true professional who keeps you informed and involved throughout the process, put the power of Ryan Nordby to work for you today!

Moving Day Count Down: A Weekly Checklist

Guest post by Laura McHolm Did you know May is National Moving Month? May is the kick-off to the busiest moving season. In fact, nearly 40 million of us move in the summer and begin to [...]

5 New Homeowner Mistakes You Can Easily Avoid (And How to Avoid Them)

The following is a guest post from Jessica Thiefels. Becoming a first-time homeowner is one of the most exciting and stressful times of your life, even after the closing papers have been signed and the [...]

Spotting Foundation Issues When Buying a Home

Buying a home is both exciting and stressful. After all, you want to find a place that suits your living needs and is in great condition. One of the biggest concerns is that the property [...]

10 Easy Fixes for That Nearly Perfect House You Want to Buy

From price and location to the physical structure itself, the list of things to keep in mind when shopping for a house can seem endless. But some problems you encounter don’t need to affect your final decision. [...]

Taking On Your Partner’s Debt: What to Ask Before You Consolidate

The following is a guest post by Jennifer Calonia. Having candid conversations with your partner about debt can feel uncomfortable, especially if you’re newlyweds or planning a marriage and future together. The reality, however, is [...]

7 Reasons Buying Beats Renting

Why Buying a Home is Better than Renting Conventional wisdom used to state that buying a home is always a great investment. But after the housing crisis, many people who saw their equity sliced in [...]

Writing the Perfect Dear Seller Letter

A dear seller letter is one thing that can give the buyer a distinctive edge in a seller’s market. When competing for a home, there are many ways to make your offer attractive to the [...]

Understanding and Choosing Smart Home Products that Are Right for Your Lifestyle

Many people are drawn into the world of smart home technology by cool features like smart lights and smart assistants, because they help make life more convenient. But it can also be somewhat intimidating for [...]

The Coldwell Banker Global Luxury Way

The Coldwell Banker Global Luxury® marketing program allows Luxury Property Specialists to seamlessly connect with the world’s most affluent clientele. It offers agents the power of a global network of 92,000 Coldwell Banker® affiliated agents [...]

5 Kinds of Mortgages: What’s Right for You

Home buying can be a whirlwind and, unless you are a lottery winner or heir to a fortune, likely includes taking out a mortgage. Choosing the right mortgage loan for your budget includes assessing your [...]

Saving for a Home: How Much Is Enough?

It's easy to get caught up in credit scores when considering a home purchase. But as lenders continue to loosen requirements, the need to have money in the bank doesn't get any less acute. Getting [...]

Reverse Mortgages: New Rules Make Them Safer for Homeowners

The promises of a reverse mortgage -- never having to pay a mortgage bill again and using your home's equity to finance retirement -- can sound too good to be true. It almost was too [...]